How can MELASOFT help you?

With Melasoft E-Invoice Solution for Malaysia, you can prepare invoice documents following the infrastructure requirements of the Inland Revenue Board (IRB) system and Malaysia legislation, which is required for companies that do or will trade in Malaysia. You can manage your B2G and B2B invoice processes entirely within the E-Invoice system, create invoice documents, automatically archive them, and complete the legal signature process.

Melasoft E-Invoice Solution for Malaysia includes a review of accounting processes for companies trading with Malaysia and preparation and analysis for integration with the IRB E-Invoice System. In addition, the Melasoft solution provides the identification of areas requiring changes, mandatory data entry, policies and procedures for responsible persons, internal controls, integration of the Malaysia electronic invoicing standard with the SAP system, electronic invoicing for XML and JSON and UBL standards.

e-Invoicing in Malaysia

Malaysia will adopt an electronic invoice system beginning June 2024. Against this backdrop, the Inland Revenue Board of Malaysia (IRBM) issued the much-awaited E-Invoice Guideline Year 2023 (Guideline) on 21 July 2023 (updated 29 September 2023). The Guideline addresses the scope of implementation of the E-Invoice which comprises the simplified e-invoice concepts, step-by-step guidance on key aspects of E-Invoice, practical examples, and common questions regarding E-Invoice.

The mandatory use of E-Invoicing covers B2G, B2B, and B2C transactions. Furthermore, domestic and cross-border transactions can be included. Electronic invoices can be used by taxpayers voluntarily from January 2024. IRB will provide a free portal called MyTax for taxpayers to issue and receive invoices manually. Starting from 2027, B2C transactions will follow the obligation and use E-Receipts. It is expected that B2C transactions will follow the real-time reporting model. The following documents will be under the scope of the regulation:

-

Credit and debit notes

-

Invoices

-

Receipts

-

Cancellations

Overview of e-Invoice

To facilitate taxpayers’ transition to E-Invoice, Taxpayers can select the most suitable mechanism to transmit E-Invoice to Lembaga Hasil Dalam Negeri Malaysia (LHDNM), based on their specific needs and business requirements.

LHDNM has developed two (2) distinct E-Invoice transmission mechanisms:

a) A PORTAL (MYINVOIS PORTAL) HOSTED BY LHDNM

-

Enables individual generation through a comprehensive form and the option for batch generation through spreadsheet upload for processing multiple transactions.

-

Accessible to all taxpayers.

-

Suitable for micro, small, and medium-sized enterprises (MSMEs).

-

May not be efficient for large volumes of data.

-

Businesses that need to issue E-Invoice but API connection is unavailable.

b) APPLICATION PROGRAMMING INTERFACE (API)

-

Enables businesses to conveniently transmit high-volume of transactions.

-

Requires upfront investment in technology and adjustments to existing systems. API connection may be made directly to LHDNM or through intermediary technology providers.

-

Ideal for large taxpayers or businesses with substantial transaction volume.

Workflow of E-Invoicing

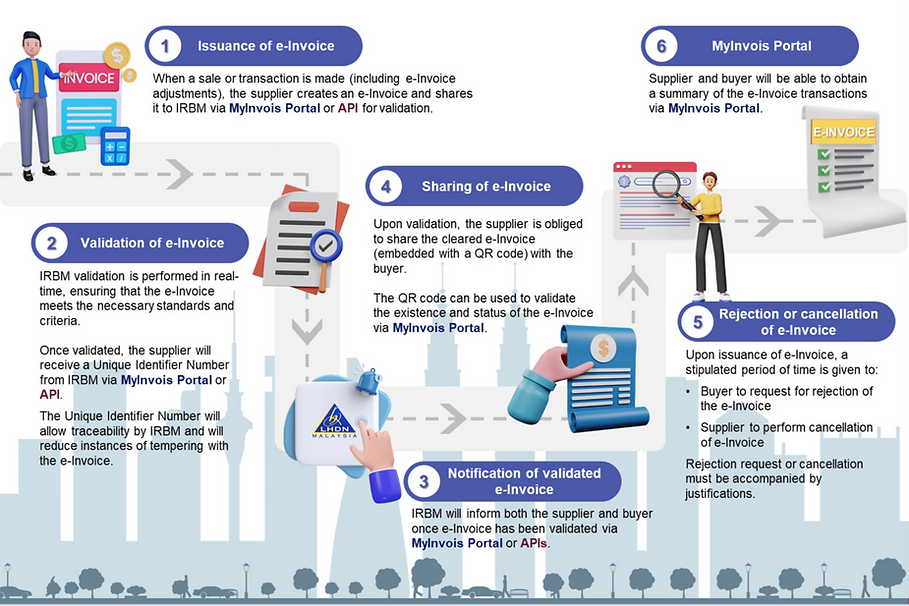

The figure below demonstrates an overview of the e-Invoice workflow from the point a sale is made or transaction is undertaken, and an e-Invoice is issued by the supplier via MyInvois Portal or API, up to the point of storing cleared e-Invoices on LHDNM’s database for taxpayers to view their respective historical e-Invoices.

In this context, it is crucial to understand the workflow of e-invoicing in general.

1. Issuance of e-Invoice

When a sale or transaction is made (including e-Invoice adjustments), the supplier creates an e-Invoice and shares it to IRBM via MyInvois Portal or API for validation.

2. Validation of e-Invoice

IRBM validation is performed in real-time, ensuring that the e-Invoice meets the necessary standards and criteria.

Once validated, the supplier will receive a Unique Identifier Number from IRBM via MyInvois Portal or API.

The Unique Identifier Number will allow traceability by IRBM and will reduce instances of tempering with the e-Invoice.

3. Notification of validated e-Invoice

IRBM will inform both the supplier and buyer once e-Invoice has been validated via MyInvois Portal or APIs.

4. Sharing of e-Invoice

Upon validation, the supplier is obliged to share the cleared e-Invoice (embedded with a QR code) with the buyer.

The QR code can be used to validate the existence and status of the e-Invoice via IRBM’s official portal.

5. Rejection or cancellation of e-Invoice

Upon issuance of e-Invoice, a stipulated period of time is given to:

• Buyer to request for rejection of the e-Invoice

• Supplier to perform cancellation of e-Invoice

Rejection requests or cancellations must be accompanied by justification.

6. MyInvois Portal

Supplier and buyer will able to obtain a summary of the e-Invoice transactions via MyInvois Portal.

E-Invoice Implementation Timeline

E-Invoice will be implemented in phases to ensure a smooth transition. The roll-out of E-Invoice has been planned with careful consideration, taking into account the turnover or revenue thresholds, providing businesses with sufficient time to adapt. Below is the E-Invoice implementation timeline:

e-Invoicing was initially expected to be implemented in phases beginning from 1 June 2024. However, acknowledging the complexities faced by businesses in the implementation of e-invoicing, the Government has deferred the mandatory implementation timeline for taxpayers with an annual turnover or revenue exceeding RM 100 million from 1 June 2024 to 1 August 2024. The mandatory implementation of e-invoicing for all other taxpayers will be in phases, beginning 1 July 2025.