Belgium’s Shift to Mandatory B2B E-Invoicing: What Your Business Needs to Know

- Melasoft

- Nov 7, 2024

- 3 min read

Updated: Mar 25

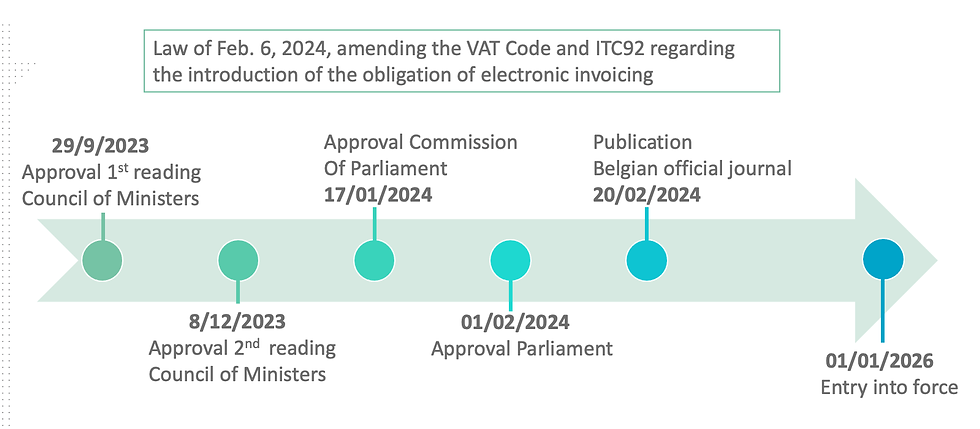

Belgium has announced that mandatory business-to-business (B2B) electronic invoicing, or e-invoicing, will take effect on January 1, 2026. This initiative, aimed at enhancing invoicing efficiency, strengthening VAT compliance, and combating tax fraud, requires VAT-registered businesses to adopt structured electronic invoices that meet specific technical standards.

Structured Electronic Invoice

Under the new Belgian legislation, a structured electronic invoice is defined as “an electronic invoice drawn up, sent, and received in a structured electronic format that enables its automatic and electronic processing.” This generally means invoices will be in XML format, enabling automated processing, while PDF invoices will no longer be recognized as VAT-compliant for B2B purposes.

Structured electronic invoices will use the Peppol-BIS format and be exchanged through the Peppol network, complying with EN 16931–1 and CEN/TS 16931–2 standards.

The Belgian e-invoicing requirements emphasize three main technical specifications:

Authenticity of Origin: Invoices must include a verifiable sender identity, commonly through secure electronic signatures.

Integrity of Content: Measures, such as digital signatures and secure transmission protocols, should ensure the content remains unchanged post-issuance.

Readability: The EN 16931 standard must be followed, guaranteeing that invoices are readable by humans and machines alike.

Scope of Mandatory B2B E-Invoicing

The scope of mandatory e-invoicing in Belgium covers three categories: supplier, customer, and transaction.

Supplier: The e-invoicing mandate applies to all Belgian VAT-registered suppliers, including Belgian establishments of foreign entities with a Belgian VAT number, VAT groups, and entities under special VAT schemes in agriculture. Exemptions include foreign entities solely registered for VAT in Belgium, VAT-exempt entities, and those declared bankrupt or operating under a special flat-rate VAT scheme (until January 2028).

Customer: Customers under this mandate must be capable of automatically receiving and processing structured e-invoices. This applies to all VAT-taxable entities in Belgium, including foreign entities with a Belgian VAT number for local Belgian transactions. VAT-exempt entities are excluded.

Local Belgian Transactions: The mandate applies to all local B2B transactions subject to VAT in Belgium, except those exempted under Article 44 of the Belgian VAT Code. Intra-Community supplies and certain services performed outside Belgium are also excluded.

Fiscal Incentives for E-Invoicing Adoption

To encourage adoption, Belgium offers fiscal incentives for e-invoicing. Small businesses can benefit from a temporary cost deduction of 120% on expenses related to e-invoicing program setup and consultancy fees, applicable from January 1, 2024. This deduction ends with tax year 2029 (taxable periods starting January 1, 2028).

Additionally, the investment deduction rate for digital invoicing-related expenses will rise to 20% starting January 1, 2025.

The Peppol Network and E-Reporting

Peppol, a decentralized network, will facilitate the secure exchange of structured electronic invoices. In Belgium, the FPS BOSA acts as the Peppol Authority to ensure effective network usage. Belgium also provides two platforms for businesses without direct Peppol access:

Mercurius: A “mailroom” service for exchanging e-procurement documents.

Hermes: A platform allowing European-wide e-invoice reception, with all Belgian CBE Enterprise Numbers pre-registered for free as Peppol receivers.

Belgium plans to implement e-reporting in alignment with the EU’s VAT in the Digital Age (ViDA) initiative. This second-phase project aims to create a five-corner model promoting interoperability and data exchange within the EU.

Current Practices and Transition Timeline

Currently, B2B e-invoicing is optional in Belgium, provided both parties agree and adhere to secure controls for issuance, receipt, and storage. Compliant invoices must align with the EN 16931 standard and the Peppol-BIS format. By December 2025, PDF invoices will no longer be accepted.

Furthermore, B2G (business-to-government) e-invoicing has been mandatory for contracts issued after March 1, 2024, while B2C (business-to-consumer) transactions remain outside the e-invoicing mandate.

Preparation Steps for Businesses

To ensure a smooth transition to mandatory e-invoicing, Belgian businesses should undertake the following steps:

Review Invoicing Processes: Evaluate current invoicing workflows and departmental impacts, particularly for VAT treatment and invoice content mapping.

Verify Customer Data: Ensure all customer master data — official name, address, and VAT number — is accurate.

Assess Software Capabilities: Verify your invoicing software’s readiness for e-invoicing and consider engaging a third-party provider for necessary IT upgrades, including access point integration.

Taking these proactive steps will help businesses meet the new requirements effectively and avoid potential non-compliance issues.

Melasoft: Ready for E-Invoice Compatibility

Belgium’s move to mandatory e-invoicing marks a significant shift for B2B transactions. By understanding the legislation and preparing ahead of time, businesses can avoid penalties and maintain a competitive edge. Don’t wait until 2026 — ensure your invoicing systems are compliant now.

Melasoft, a notified Peppol Access Point by the Belgian Ministry of Finance, is ready to support Belgian businesses in their transition to automated, compliant e-invoicing.

Feel free to contact us for assistance!

Comments